The Latest on Our Fight Against Coronavirus

I know these past weeks have been particularly difficult for many Americans as you have been forced to celebrate Passover, Easter, and Ramadan away from your loved ones. Please know that continuing to following CDC guidance even when we most would have liked to be with our families helped keep our community safer. I'm wishing you and your friends and families the best.

Last week, I returned to Washington, D.C. to vote with my colleagues on The Paycheck Protection Program and Health Care Enhancement Act, a bipartisan agreement to provide interim emergency funding for the Paycheck Protection Program (PPP), SBA's Economic Injury Disaster Loan (EIDL) Program and EIDL Grant Program, and hospitals and health care centers.

As you may have heard, both the PPP and EIDL programs ran out of funding shortly after the passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. There has also been a lot of confusing and sometimes contradictory information released to the public about the resources included in the CARES Act. Through this email, I hope to provide clarity on two of the topics that I have been most asked about in recent weeks. Further down, you will find information on stimulus payments and small business assistance that I hope answers many of your questions.

Be sure to follow my Twitter, Facebook, and Instagram accounts and subscribe to my newsletter to stay updated throughout this crisis.

For the latest information from the Centers for Disease Control and Prevention please visit cdc.gov/coronavirus.

For the latest information from the Chicago Department of Public Health, please visit Chicago.gov/coronavirus.

Sincerely,

Mike Quigley

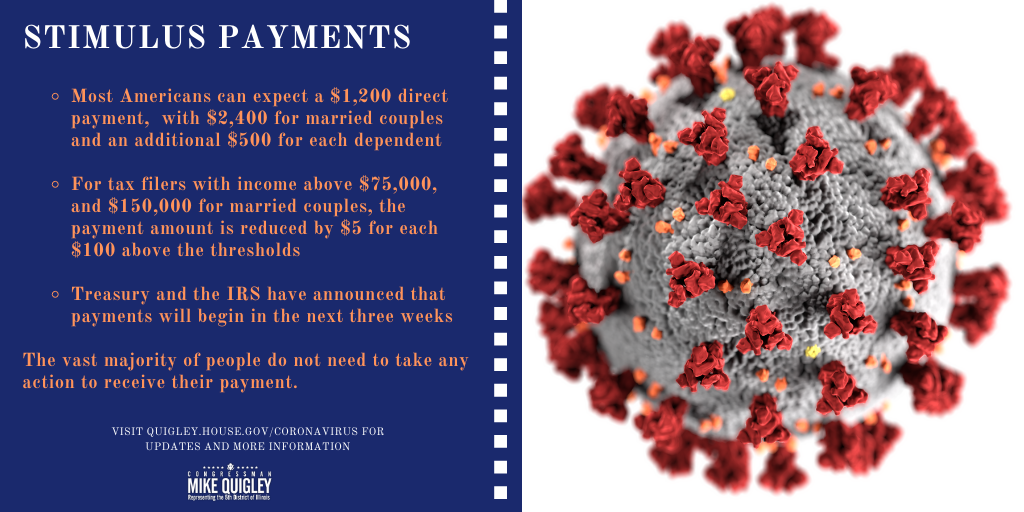

Stimulus Payments

On March 27, Congress passed a historic $2.2 trillion economic stimulus and relief package aimed at continuing our coronavirus public health response and stabilizing our economy. This included $1,200 in direct assistance payments to most Americans, $2,400 for married couples and an additional $500 for each child. Tax filers with an adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples who filed joint returns will receive the full payment. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. The payment completely phases out for single filers with income exceeding $99,000 and $198,000 for joint filers with no children.

The vast majority of people do not need to take any action to receive their payment. The IRS will calculate and automatically send the economic impact payment straight to you. For people who have already filed their 2019 tax returns, the IRS will use this information to calculate your payment amount. If you have not yet filed your return for 2019, the IRS will use information from your 2018 tax return. Social Security recipients, Supplemental Security Income recipients, VA pension recipients and railroad retirees who are not required to file a tax return do not have to file to receive their stimulus check, they will automatically receive $1,200. If these individuals want to claim an additional $500 for an eligible dependent they must enter information into the "Non-Filers: Enter Payment Info Here" tool on the IRS website. Please note: The deadline has passed for social security recipients and railroad retires to enter information to receive additional money for their dependents. Other non-filers, will have to use the "Non-Filers: Enter Payment Info Here" tool to receive their stimulus payment.

If you have not filed your 2018 or 2019 return yet, the IRS highly encourages you to file your federal tax return as soon as possible to receive your stimulus check. It's also worth noting that the majority of filers will also get a refund on their taxes, which could be useful right now. If you need help filing your return or need to visit a tax professional or local community organization in person to get help, you should know that these payments will be available for the rest of 2020.

You will not be required to pay taxes on your stimulus check now or in the future. If you find the credit was greater than you should have received, you will not be required to pay the excess credit. On the flip side, if the credit you receive is found to be less than what you should have received, you will be able to claim the difference on your 2020 returns.

If you have direct deposit set up with the IRS you will receive your stimulus check directly into your bank account. The first stimulus checks were distributed over the past two weeks and additional payments will continue being distributed. For Americans who do not have direct deposit set up, the IRS has an online portal "Get My Payment" tool for individuals to enter their direct deposit information and check the IRS website for updates. For everyone else, a check will be mailed to your address.

Click here to visit the IRS website for more information on these payments.

Small Business Assistance

The CARES Act included $377 billion in relief for small businesses, including the paycheck protection program (PPP) loan, loan advances for the Economic Injury Disaster Loan (EIDL), debt relief for some non-disaster SBA loans, additional funding for resource partners, including Small Business Development Centers and Women's Business Centers, as well as tax provisions such as employee retention credit, and the delay in payroll taxes.

Please note federal funding for the Paycheck Protection Program and the Economic Injury Disaster Loan and Loan Advance ran out of funding and at that point applications were no longer accepted. The Paycheck Protection Program and Health Care Enhancement Act, which Congress passed and has been enacted into law, restores funding to these programs. SBA and lenders have resumed accepting applications.

Access to Funding

Paycheck Protection Program:

- General Information: The Paycheck Protection Program (PPP) is a new program that provides cash-flow assistance through 100 percent federally guaranteed loans to employers who maintain their payroll during this emergency. If employers maintain their workforce, SBA will forgive the portion of the loan proceeds that are used to cover 8 weeks of payroll and certain other expenses following loan origination. Up to 100 percent of the loan is forgivable. This loan has a maturity of 2 years and an interest rate of 1%.

- Dates: Loans are available through June 30, 2020. Applications are currently being accepted for small businesses, sole proprietorships independent contractors and self-employed individuals.

- Apply:

- For Borrowers: Apply directly through any existing SBA 7(a) lender or through any federally insured depository institution, federally insured credit union, and Farm Credit System institution. Other regulated lenders will be available to make these loans once they are approved and enrolled in the program.

- For Lenders: Non-SBA lenders seeking to enroll as a participating SBA Lender to make Paycheck Protection Program financing click here and scroll to the bottom for information.

- More Information: More information on eligibility and details on the loans can be found on either the Small Business Association's website here or the Treasury's website here.

Economic Injury Disaster Loan and Loan Advance:

- General Information:

- Economic Injury Disaster Loan (EIDL) program provides small businesses with low interest working capital loans of up to $2 million that can provide vital economic support to small businesses to help pay fixed debts, payroll, accounts payable, and other bills.

- Economic Injury Disaster Loan Advance provides an emergency advance of up to $10,000 to small businesses harmed by COVID-19 within days of a successful application and will not have to be repaid.

- Dates: Illinois small businesses are currently able to apply for EIDL and loan advance now.

- Apply: Businesses apply for EDIL and Loan Advance directly through the Small Business Association's (SBA) website. It is the same application process for both, upon applying or an EIDL you request the advance. EIDL and Loan Advance application.

- Note: Businesses that applied for an EIDL loan prior to 3/29/20 need to apply for the loan advance.

- More Information: For more information please visit SBA's website here.

SBA Debt Relief Program:

- General Information: The SBA debt relief program provides immediate relief to small businesses with non-disaster SBA loans, in particular, 7(a), 504 and microloans. The SBA automatically will pay the principal, interest, and fees of current 7(a), 504, and microloans for six months. SBA will also automatically pay the principal, interest, and fees of new 7(a), 504, and microloans issued prior to September 27, 2020.

- Apply: To find out if your business's current loan is automatically deferred, please contact your Loan Servicing Office directly using the following information:

- Birmingham Disaster Loan Servicing Center:

- Phone: 800-736-6048

- Email: BirminghamDLSC@sba.gov

- El Paso Disaster Loan Servicing Center:

- Phone: 800-487-6019

- Email: ElPasoDLSC@sba.gov

- Birmingham Disaster Loan Servicing Center:

- More Information: For more information about this and additional debt relief please visit SBA's website here.

Tax Provisions

Employee Retention Credit

- General Information: The Employee Retention Credit is a fully refundable tax credit equal to 50 percent of up to $10,000 in qualified wages (including health plan expenses) that Eligible Employers pay their employees. This credit applies to qualified wages paid after March 12, 2020, and before January 1, 2021. Eligible employers can reduce federal employment tax deposits in anticipation of the credit. They can also request an advance of the employee retention credit for any amounts not covered by the reduction in deposits.

- Note: This credit is not available toemployers receiving assistance through the Paycheck Protection Program. For other restrictions visit the IRS website.

- Dates: Eligible Employers may claim the Employee Retention Credit for qualified wages that they pay after March 12, 2020, and before January 1, 2021.

- More Information: Please find more details on this credit on the IRS website here.

Deferral of Employer Payroll Taxes

- General Information: This allows businesses to defer paying the employer portion of certain payroll taxes through the end of 2020, with all 2020 deferred amounts due in two equal installments, one at the end of 2021, the other at the end of 2022. Payroll taxes that can be deferred include the employer portion of social security taxes and certain railroad retirement taxes.

- Note: Deferral is not available to employers receiving assistance through the Paycheck Protection Program.

- Dates: The deferral applies to deposits and payments of the employer's share of social security tax that would otherwise be required to be made during the period beginning on March 27, 2020, and ending December 31, 2020.

- More Information: Please find more details on the deferral on the IRS website here.

Please visit quigley.house.gov/coronavirus for information on CDC guidance for fighting coronavirus, updates on Congress' latest action to fight the coronavirus pandemic, and local resources for you, your families, and your businesses.

You can continue to contact me or my staff through my website at quigley.house.gov/contact or by phone at (202) 225-4061 or (773) 267-5926.